The Ultimate SMB’s 2023 Guide for Account Receivable Recovery

As a small or medium-sized business, it’s important to manage your accounts receivable effectively to maintain the financial health of your company. In this guide, we will cover the basics of accounts receivable, the different methods of recovery available, and how to protect your brand while collecting overdue payments. We’ll also provide tips and considerations for maximizing your chances of success in recovering overdue payments from debtors. Whether you’re new to managing accounts receivable or an experienced pro, this guide is designed to provide valuable insights and best practices for recovering overdue payments and improving your cash flow. Good luck!

Introduction

Here is a short intro for important terms (experts may skip this part):

Accounts receivable (AR)

Money owed to a business for delivered goods and services.

1st party recovery

A “filtration process” to identify and recover “low-hanging fruit” accounts. This allows AR recovery without the costly process of collections.

Pre-collection

A “filtration process” to identify and recover “low-hanging fruit” accounts. This allows AR recovery without the costly process of collections.

3rd party collection

When a business hires an outside company to collect overdue accounts on its behalf. Third-party collections can affect a customer’s credit score and include legal action to retrieve debt.

Days sales outstanding (DSO)

A financial metric that measures the average number of days for a company to collect payment after a sale. It is calculated by dividing the company’s accounts receivable by its average daily sales, then dividing that number by the total number of days in the measured period

Overdue account age

The length of time the account receivable remains unpaid

What is the best way for my business to recover debts?

There are several methods a company can use to recover past-due or defaulted accounts receivable:

A business handles the collection of its debts using a company stakeholder or AR department, rather than outsourcing the task to a collection agency.

| Pros | Cost saving potential. A business that collects its own debts avoids paying a debt collection agency to do so on its behalf. In addition, it allows the business to protect its brand name through personalized communication with its customers. |

| Cons | Time-consuming and ineffective. Employees may not have the proper training and resources to collect debts, in addition to their regular duties. |

| Pricing | Depends on the necessary time and resources. |

| Timing | The amount of time and staff expertise available to collect an overdue invoice. |

A program that automates recovering accounts receivable. This software manages the recovery process, from sending reminders and follow-up messages to tracking payments and negotiating payment plans.

| Pros | With an automated recovery process, businesses reduce costs by avoiding time-consuming manual labor. Additionally, pre-collection software increases recovery rates by customizing the collection process based on each debtor’s needs. The software handles large volumes of recovery requests, /offers optimal timing and multiple channels that lead to higher recovery rates, and helps protect the company’s brand. Overall, AR recovery software helps businesses improve their cash flow and protect their brand while reducing costs. |

| Cons | Businesses are often required to pay for the use of the software regardless of its success in recovering debts. This means that there is a risk of losing money if the software is not effective. Additionally, recovery rates for accounts over six months old may be lower when using AR recovery software. This is because older accounts may be more difficult to recover and may require more personalized and targeted approaches in order to be successful. |

| Pricing | Offered through a monthly subscription or pay-per-account model. Most software does not operate on a contingency basis. The cost will vary depending on the specific software and the features it offers. |

| Timing | Submitting the account at a young age improves the recovery rates substantially. We recommend sending them from the first-day account is overdue until the age of 90 days. |

🏢 Collection Agencies

A collection agency is a company that specializes in collecting debts on behalf of businesses.

| Pros | Potential for increased success in collecting outstanding debts. Collection agencies often have specialized knowledge and resources for tracking down debtors and negotiating payment plans. This can be especially beneficial if a business lacks the time or expertise to handle the collection process. Additionally, using a collection agency allows a company to distance itself from the collection process, which can be a harsh and time-consuming job. |

| Cons | For one, the agency will charge a fee for its services, which can be a significant cost to a business. Additionally, there is the risk that the agency may use aggressive or unethical tactics to collect debts, which can damage a company's brand. There is also the potential for miscommunication between the business and the collection agency. |

| Pricing | Agencies often work on a contingency basis, charging a percentage of the debt collected. They may also charge a service fee. The cost of using a collection agency will depend on the specific terms of the agreement and the amount of the outstanding debt but usually ranges between 20%-50%. |

| Timing | If a business has a large number of outstanding debts and lacks the resources to handle the collection process, a collection agency may be a good option. On the other hand, if the business has a small number of outstanding debts and strong relationships with its customers, it may be more effective for it to handle the collection process. |

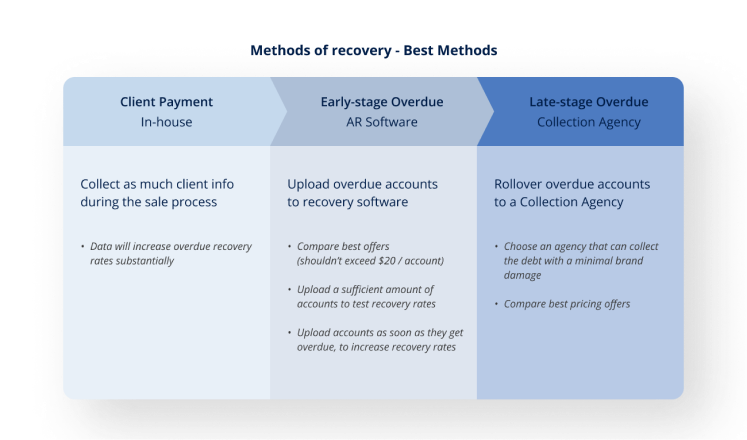

What are the best practices for recovering debt?

We recommend using a combination of different methods to maximize the chance of collecting outstanding debts and ensuring the highest return on investment (ROI)

| AR Department | Takes full responsibility to resolve the debt throughout the entire process. Recommended for bigger companies with recovery expertise. |

| Debt Sale | A good choice for high account volumes, since each account recovers a few pennies on the dollar. |

| Ignore Debt | Not recommended. It decreases cash flow and revenue. However, it protects a company brand. |

What are the reasons debtors don’t pay?

There are many reasons why debtors don’t pay their accounts. Some of the most common reasons include:

| Financial difficulties | Merchants may experience financial difficulties that make it difficult for them to pay. This could be due to a variety of factors, such as declining sales, unexpected expenses, or difficulty accessing credit. |

| Disagreements | Merchants may choose not to pay their debts due to disagreements with the creditor. These disagreements may include the terms of the agreement, the quality of the goods, or the services provided. |

| Miscommunication | Merchants might miss payments on their debts due to a lack of communication or misunderstanding about the payment process. For example, they may not have received an invoice or may not be aware of the payment deadline. |

| Fraud | In some cases, merchants might not pay their debts because they have engaged in fraudulent activity, such as misrepresenting the terms of the agreement or failing to deliver goods or services as promised. |

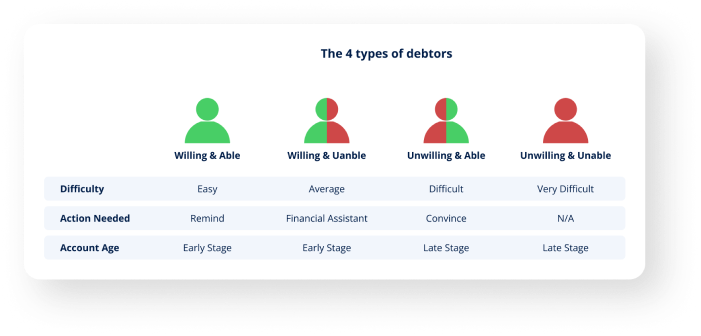

Who are the 4 types of debtors?

There are four main categories of debtors and understanding these categories can be helpful for businesses to collect outstanding debts:

| Willing & able | This is the easiest group from whom to collect debts. These debtors are motivated to pay and have the financial resources to do so. |

| Willing & unable | These debtors are motivated to pay but may require assistance in negotiating a payment plan. |

| Unwilling & able | These debtors may be resistant to negotiations. They require more aggressive tactics, including legal action to collect payment. |

| Unwilling & unable | These are the most challenging debtors. They have little motivation to pay and may not have the financial resources to do so. |

New Debtors. New Solutions.

There is a new generation of debtors who are more difficult to reach through traditional methods, such as phone calls and physical letters. This can be a challenge for businesses that rely on these recovery methods.

One reason for this trend is that many people rely on email and text messaging for communication. As a result, traditional methods are less effective for reaching these debtors. Additionally, some people may avoid phone calls or physical letters out of fear, or because they are overwhelmed by other financial responsibilities.

To address these challenges, businesses need to adapt their debt collection strategies to include modern methods of communication, such as email or text messaging; offering an option to submit payments through a secure online portal; and providing payment plans. By being proactive and flexible, businesses will improve their chances of successful debt collection.

Why is it important to protect your company brand?

Protecting a brand while recovering overdue payments is crucial for businesses of all sizes, especially for SMBs where every client is highly valuable. A strong brand reputation is a company’s most valuable asset and it is important to protect it at all costs.

| Maintain a positive reputation | When a business is known for fairness and reasonable recovery payment methods, it helps to build trust and goodwill among customers. This in turn leads to repeat business and a positive reputation in the marketplace. |

| Avoid legal issues | If a business is too aggressive in its efforts to recover overdue payments, it may run the risk of consumer lawsuits and damaging its company brand. By taking a reasonable approach to recovering overdue payments businesses will avoid these issues and protect themselves from potential legal action. |

| Achieve high customer relationships | When customers feel that a business is treating them fairly and with respect, they are more likely to continue doing business with that company. This can be especially important for businesses that rely on repeat customers and long-term relationships. |

Overall, protecting the company brand is essential for businesses when recovering overdue payments. By taking a fair and reasonable approach, businesses can maintain a positive relationship with their customers and avoid legal issues.

How do you protect your brand?

By taking the right approach, businesses can maximize their chances of success and avoid damaging their customer relationships.

| Be professional and respectful | When working with debtors, it is important to remember that the debtor is a customer and should be treated with respect. This means avoiding aggressive or confrontational language, and instead focusing on finding a solution that is mutually beneficial. |

| Be understanding and empathetic | Many people who are behind on their payments may be going through a difficult time and it is important to take this into account. By showing empathy and offering support, you can often find a satisfactory solution for both parties. |

| Be clear and concise | This means providing the debtor with all of the necessary information, such as the amount owed and the payment options available in a straightforward and easy-to-understand manner. By doing this, businesses can help the debtor understand their situation and take the appropriate steps to resolve it. |

Overall, protecting the company brand is essential for businesses when recovering overdue payments. By taking a fair and reasonable approach, businesses can maintain a positive relationship with their customers and avoid legal issues.

The 10 Commandments of AR Recovery 📜

By taking the right approach, businesses can maximize their chances of success and avoid damaging their customer relationships.

- ℹ Always gather client data – this will improve debt recovery rates.

- 🖥 Automate the debt collection process – provides a faster resolution that reduces costs and increases revenue recovery.

- 🎭 Understand each debtor is different – customizing the payment process will maximize debt recovery.

- 🙋♀️ Be a human, not a robot – be professional, respectful, understanding, emphatic, clear, and concise. Remember, we are dealing with people.

- 📧 Provide multiple communication channels – make it easy for the debtor to contact you.

- 💸 Provide multiple payment options – make it easy for the debtor to pay

- 📈Streamline the collection process – use the right tools to quickly guide the payment process.

- ⭐ Start with 1st party software, continue to 3rd party agency – this automated process reduces costs and increases revenue recovery.

- 📊 Measure recovery rates – determine what needs improvement in the debt collection process.

- 🤝 Work with reputable companies – this protects a company’s brand and its customer relationships.

About Last Demand

We’re a first-party pre-collection platform that simplifies the process, improves cash flow, and protects your brand.

Our fully automated platform uses complex data to customize the recovery process and maximize payments.

Backed by Cedar Financial, one of the biggest AR management firms, we offer the complete recovery process, including pre-collection automation and rollover (of the remaining accounts) to a collection agency.